With the arrival of the new year of photography and new shows, books, auctions, and events already tempting us on the forward calendar, it is our custom to begin the year with a quick look back at the previous 12 months, with an eye to larger trends and patterns that can only be seen with the benefit of some distance. Last year, we tallied preview and results data for 60 different auctions around the world, detailing both specialist photography and photobook sales as well as contemporary art auctions that included a significant percentage of photographic lots. In the face of many who find the reporting of auction results insidiously crass and money driven (or better yet, the absolute antithesis of everything art should be about), it is our contention that auction data has the potential to tell us something about changing tastes and overall market movements, and that collectors of all kinds ought to at least be aware of these larger forces as they make their own choices and trade-offs, even if we ultimately decide to dismiss them as unrelated to our own micro-interests. They are one window to look through when trying to make sense of the world of photography; not the only one or even the most important, but still valid as a point of possible analysis.

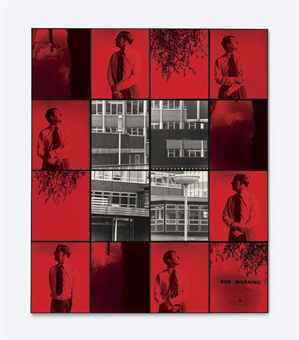

So let’s start with the raw data itself. In the slideshow below, the top ten photography lots sold at auction in 2013 are shown in descending price order, with image details, estimates and realized prices, and venues/dates as background (images courtesy of Christie’s, Sotheby’s, and Phillips, unfortunately in somewhat varying sizes):

Here’s the summary data in table form, for easier comparison:

| 1.) Jeff Koons | $9405000 |

| 2.) Andreas Gursky | $3511835 |

| 3.) Andreas Gursky | $2507755 |

| 4.) Andreas Gursky | $2416475 |

| 5.) Cindy Sherman | $2045000 |

| 6.) Andreas Gursky | $1925000 |

| 7.) Gilbert & George | $1805000 |

| 8.) Cindy Sherman | $1565000 |

| 9.) Thomas Struth | $1334155 |

| 10.) Andreas Gursky | $1323750 |

So what can we conclude from this list of images? Aside from the outlier of the early Jeff Koons light box/transparency (which might not fit into everyone’s rigid definition of photography and was clearly seen/priced in the context of his larger output), what we can see is a continued clustering around a few familiar names: Andreas Gursky, Cindy Sherman, Gilbert & George, Thomas Struth, and even Richard Prince, who didn’t make it into the top 10 this year, but had a handful of works in the next 10 on the longer list. I think this concentration comes as a result of the straightforward thinking of contemporary art collectors crossing over into contemporary photography – if I’m only going to own a handful of photographs in the context of a larger sampler of contemporary art and I’m not a photo expert looking for vintage rarities, then a large picture (and nearly all of these photographs are physically large, the scale increasing their wall power) by a recognizable name is what I’m after. A Gursky stock exchange or a Sherman centerfold has become this kind of commodity, and I’m glad to see Gilbert & George’s excellent early work starting to deservedly generate more interest.

While there has been plenty of talk about art market bubbles of late, the 2013 results above do not point to a bubble in contemporary photography. There are no world records here, no head scratching examples of irrational exuberance or two stubborn bidders going haywire; the prices are high, no doubt about it, and likely there is some slow price inflation of secondary imagery at work, but overall, these results aren’t unexpectedly high in the context of data across the past several years. It’s a slow march upward for these trophy lots, not a jagged, unpredictable spike.

As we look ahead to 2014, the key thing to remember is that auction data is inherently driven by the arrival rate of top quality consignments; we won’t typically find astonishing works coming to market unless sellers are feeling confident about the strength of the likely outcomes, and if we don’t see great pieces coming to market, we won’t see prices that grab our attention – it’s all one big interrelated system that is constantly evolving. While there are a few highlights in the slideshow above, 2013 was generally a year with few superlative consignments; if confidence remains high on the part of sellers, perhaps we can look forward to more exciting previews in the months ahead.